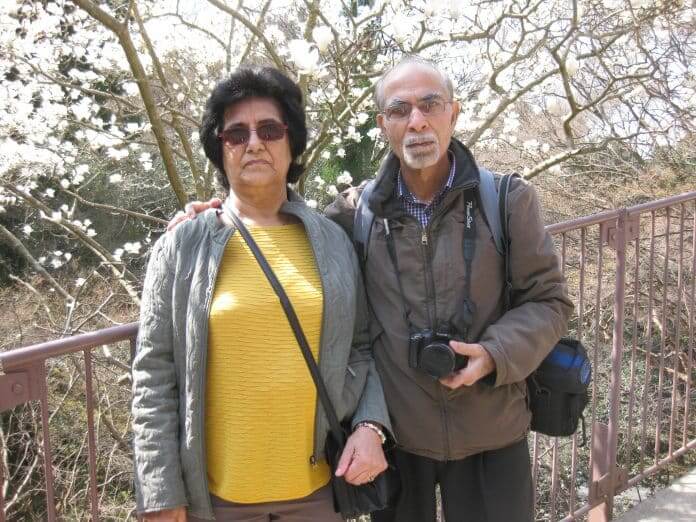

RETIRED COUPLE

Dr Tilak Kalra (Retd Chemical Engineer, Acupuncturist) and wife Bindu (Home-maker)

Would you say you’ve achieved your financial goals?

Yes I think I have achieved my financial goals reasonably well. I’m 78 years old and continue to work, but only because it gives me much joy. I came to this country in my late 20s to do a PhD at Monash University. I worked as a chemical engineer in Canberra and in Sydney and retired from full-time work in 1997. A few years before that, I stumbled onto acupuncture as a means to treat a neck problem. I took it up with a passion, studied it, and have been working part-time since my retirement as an acupuncturist. Somewhere along the line I made a decent investment in property which worked well.

Do you rely on Australian pension, or are you self-funded?

It’s a combination of Super, part pension, and my own work.

Did you plan your retirement in detail?

Not really, it all just happened, but luckily it happened well. I did not ever think I would be working as an acupuncturist in my retirement, but I have had repeat clients, some of them for eight years.

Are you dependent on your children for financial support?

No. Both our sons are financially well-settled. Both did brilliantly at uni, went on to rewarding careers and have made excellent financial decisions for their own families.

If you had to give one piece of advice to the younger generation about planning finances, what would it be?

Start thinking about your financial journey early on. Better to get a foot into the property market by buying wherever you can afford, and then upgrade later on.

If you had stayed on in India, would you have been financially better off or worse?

My cohort at Roorkee University, nearly all of who went on to great jobs such as professors in university, retired at 58-60 as is the norm in India. Pensions there have gone up significantly now and they are all quite comfortable. Would I have been better off financially? It’s hard for me to say, but I reckon I would have been ok.

Are you ok with splurging now and then on luxuries like travel?

Most definitely. Bindu and I enjoy our travel twice a year, sometimes three times. Just got back from Mongolia! I’ve now travelled to every continent except Antarctica, and am looking forward to going there – even though I’ve been to the Arctic Circle.

Tips and tricks you use to curb expenses and stop spending / start saving?

Firstly, don’t overdo anything. Second, plan well. For instance for my travel trips I plan six months in advance. I’m off to Nepal and Bhutan in September, but it is all booked and planned.

What are your thoughts on Wills and estate planning?

I have a fair bit of experience on this, both here and in India. I’ve had to intervene in a major way to help one of my closest and earliest Aussie friends here. His life was in shambles in his old age; he lost his wife and only child and then made some poor decisions in his dementia (or had them made for him by supposed carers). It took a court case and many hours on my part to sort that out. And then in India, issues from own my family property settlements taught me many lessons. Today Bindu and I have a Will, which we prepared ourselves but had a lawyer look through and fine-tune. Both our boys have seen it and fully understand all the intricacies involved. I think it is very, very important to have this sorted out.

READ: How Mohan Singh and Anubhuti, a YOUNG FAMILY, manage money

READ: How Jyotika Singh (Joy), a SINGLE PARENT, manages money

READ: How Ash Isaacs and Manisha, a YOUNG FAMILY, manage her finances

READ: How How Chinmay Sohoni and Neha, NEW MIGRANTS manage money

READ: How Dipanjali Rao, a SINGLE WOMAN, manages her finances

READ: How Sumit Sharma, a SINGLE MAN manages his finances

Money Matters: retired couple

You work for your money, but does your money work for you? As the financial year comes to a close, we ask the question, how well do you know your money?

Reading Time: 3 minutes